Role: Lead UX/UI Designer

Team: UX Design Lead (me), Product Manager, 2 AI Engineers, Front-End Developer, IRS Compliance Officer, Accessibility Specialist

Goal: Enhance support and self-service capabilities for tax professionals inside the secure IRS Tax Pro Account.

Date: 2024-2025

Problem

Tax professionals often face delays resolving account and client authorization questions within the Tax Pro Account. The current system requires navigating multiple FAQ pages, calling IRS support lines, or waiting for secure messages to be answered — which can take hours or days.

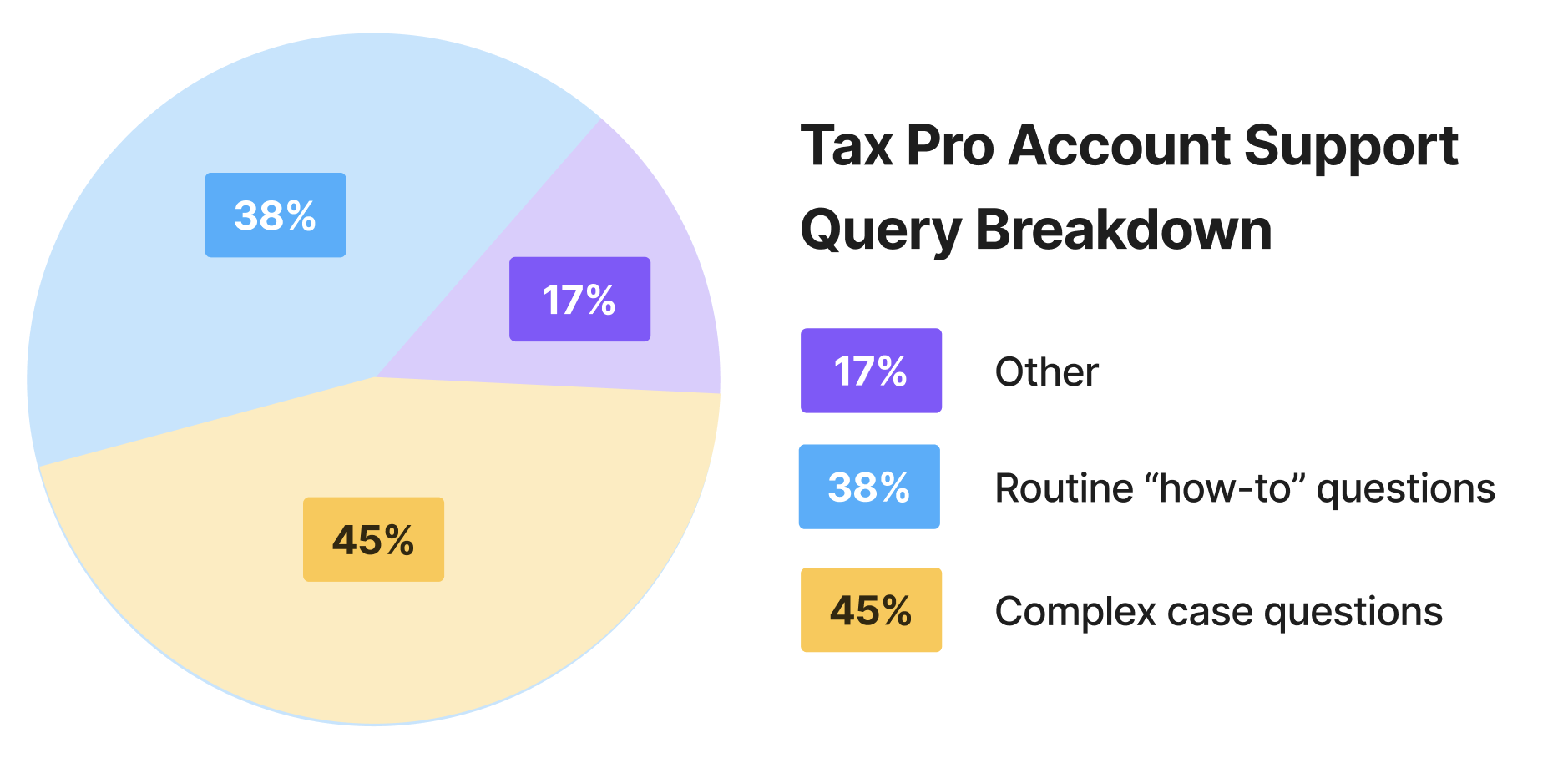

Challenges identified from analytics & interviews:

- 38% of secure messages are basic “how-to” or “where to find” questions.

- IRS call centers experience high seasonal spikes, leading to 30+ minute wait times.

- Tax professionals expressed frustration at switching between multiple sections to find relevant info.

Objective

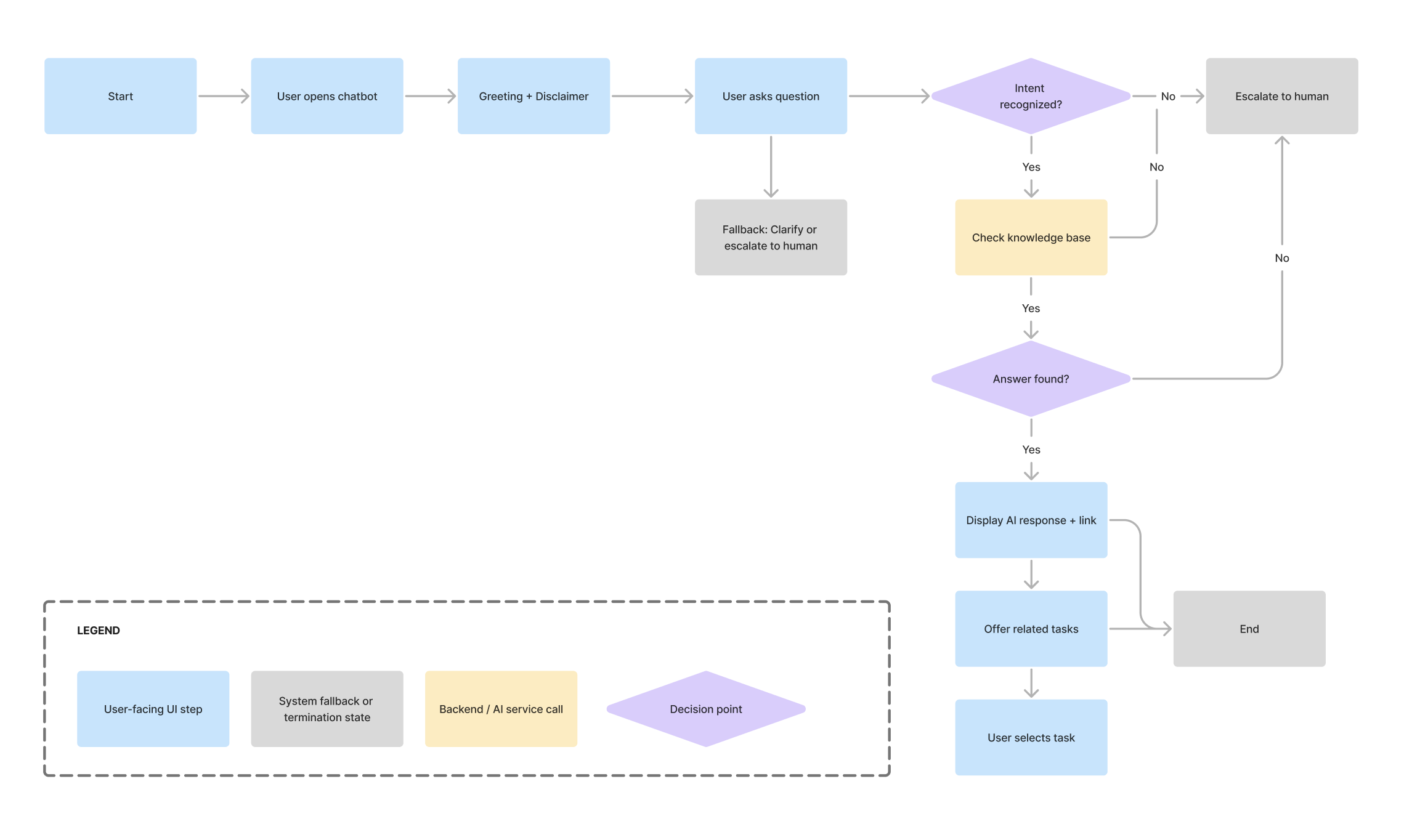

Design and validate a secure, AI-powered chatbot embedded within the authenticated Tax Pro Account to:

- Provide instant answers to account-related questions.

- Guide users through task completion (e.g., submitting a CAF request, checking authorization status).

- Reduce IRS support load by deflecting low-complexity queries.

- Maintain compliance with IRS security, privacy, and accessibility standards.

Research & Discovery

User Research

- Participants: 12 enrolled tax professionals from prior usability studies.

- Methods: Contextual inquiry, task walkthroughs, and think-aloud sessions.

- Key insights:

- Time sensitivity — tax pros need answers mid-client session.

- Trust in official responses — answers must be perceived as IRS-approved.

- Step-by-step guidance is preferred over bulk information dumps.

Competitive Benchmarking

- Studied AI assistants from banking, healthcare, and government portals (e.g., VA.gov, SSA.gov).

- Observed trends:

- Structured fallback to human support.

- Clear disclosure when AI is used.

- Integration with authenticated data to personalize answers.

Stakeholder & Technical Constraints

- Authentication: Must only be available to logged-in users via existing IRS SSO.

- Security: All interactions must be logged for auditing; no generative AI output can be stored outside IRS secure environment.

- Model limitations: No direct internet access; must be trained/fine-tuned on IRS-approved data sources (FAQs, procedural docs).

- Accessibility: WCAG 2.1 AA compliance; full keyboard navigation; screen reader-friendly.

- Data Privacy: No PII stored in AI model responses; sensitive queries routed to human agents.

Solution Approach

Key Features

- Task-Oriented AI Assistance

- Example: “Help me check my CAF status” → step-by-step, with direct deep links to authenticated pages.

- Hybrid AI + Knowledge Base

- Combines an IRS-approved FAQ dataset with a fine-tuned LLM for natural language understanding.

- Context-Aware Responses

- Knows the user’s current page and offers relevant help without starting over.

- Fallback to Human

- Clear escalation path to secure messaging or live chat with IRS agents.

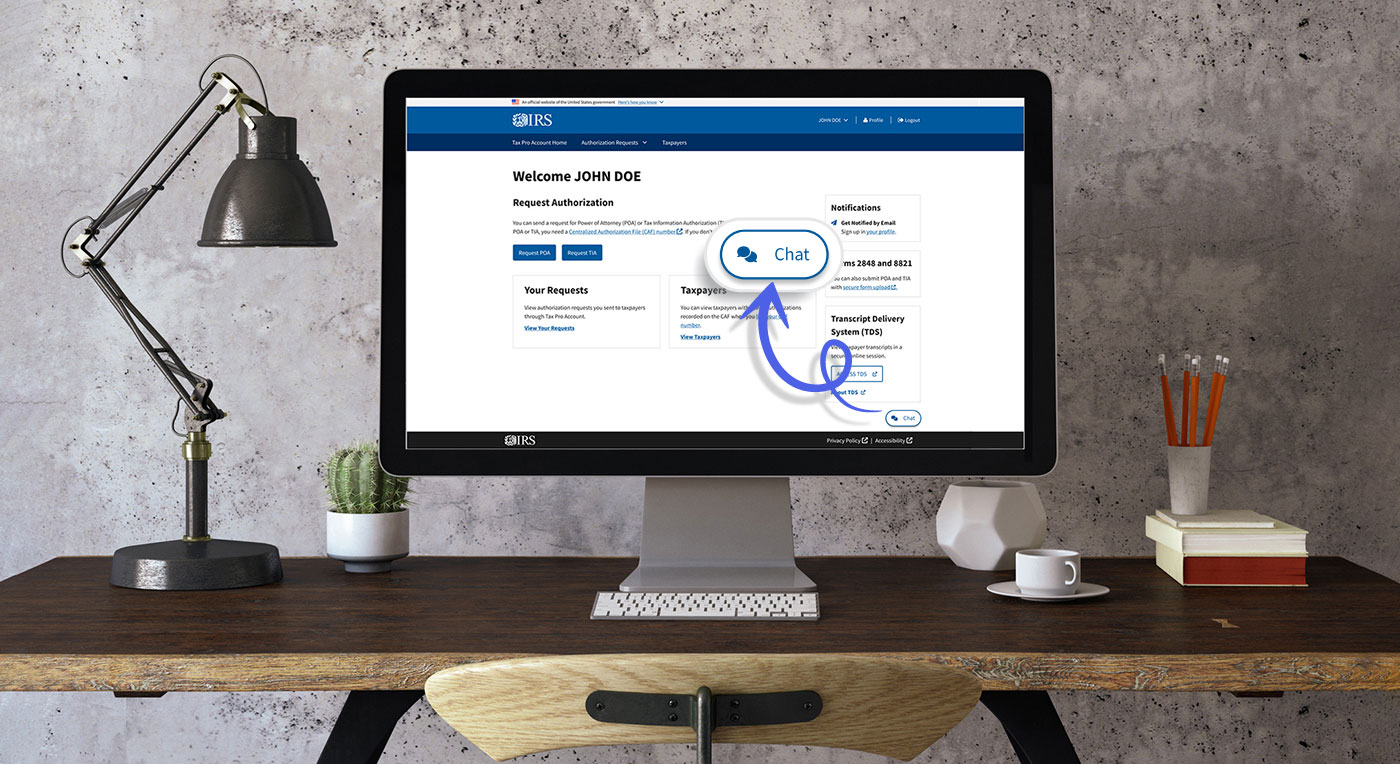

Information Architecture

Chatbot positioned as a persistent floating button in authenticated screens, with:

- Compact Mode: Quick question input.

- Expanded Mode: Full conversation history, clickable IRS links, and task checklists.

Technical Collaboration

- Partnered with AI engineers to define data ingestion from IRS-approved content sources.

- Worked with compliance to develop AI guardrails:

- Pre-approved answer templates for sensitive queries.

- Auto-disclaimer in every response (“Responses are generated from IRS-approved resources. For official determinations, see IRS.gov or contact an IRS agent.”).

- Used mock API to simulate model responses in Figma prototype for usability testing.

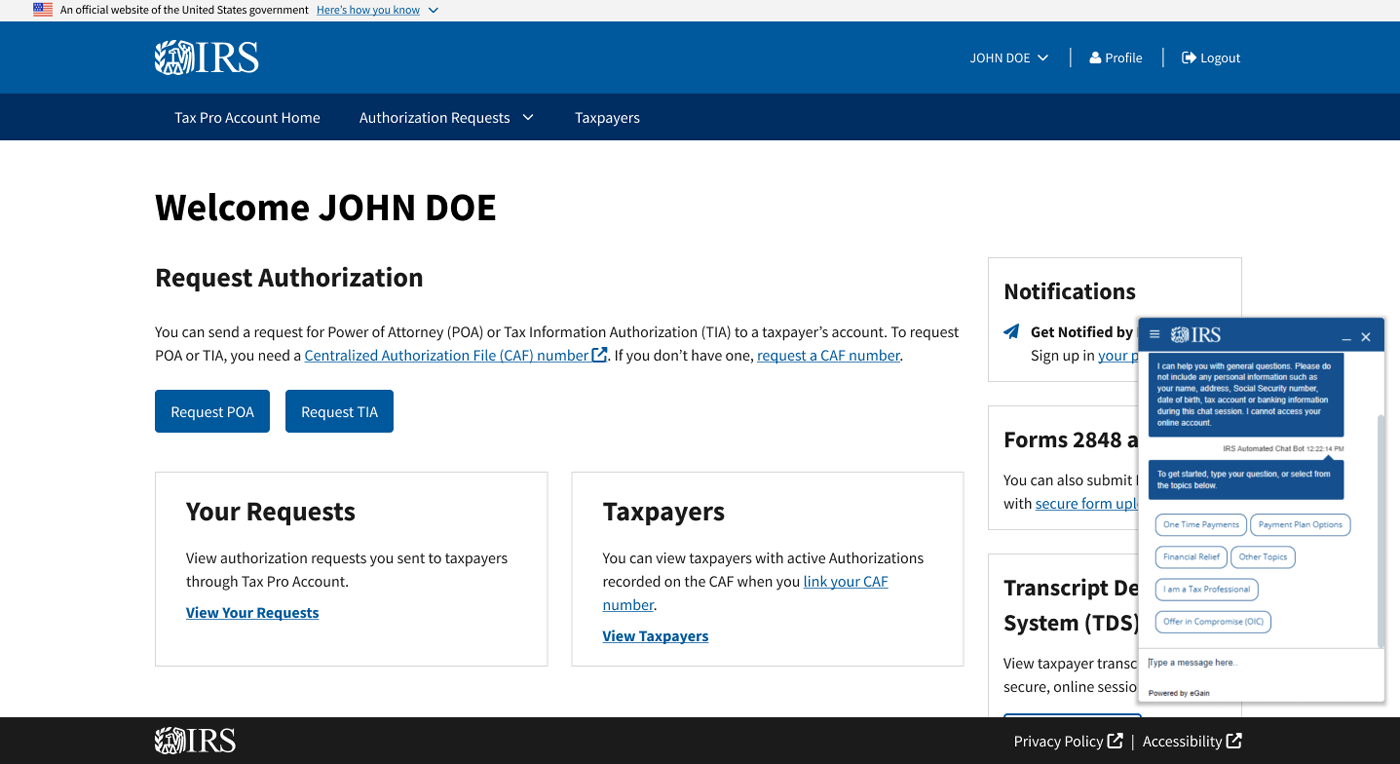

Prototyping & Testing

- Low-fidelity wireframes in FigJam → validated task flow with stakeholders.

- High-fidelity interactive prototype in Figma using USWDS components.

- Usability Testing (n=6):

- 83% successfully completed “Check CAF status” without external help.

- Users rated speed and clarity as “excellent” compared to secure messaging.

- Feedback: add “recent questions” and clarify when a human takes over.

Outcomes (POC Stage)

- Estimated 30–40% deflection of routine support queries.

- Reduced average “time to answer” for basic questions from hours/days → under 1 minute.

- Positive trust perception when answers were paired with direct links to IRS.gov.

- Engineering validated feasibility within IRS secure cloud environment using a fine-tuned, no-internet LLM.

Next Steps

- Pilot with a subset of Tax Pro Account users during non-peak season.

- Gather analytics on:

- Deflection rate.

- Task completion rate.

- AI accuracy vs. human verification.

- Train model on anonymized chat logs to improve intent recognition.

Reflection

Leading this initiative required balancing innovation with strict compliance and accessibility. The biggest challenge was ensuring trust and accuracy while introducing AI into a regulated, security-heavy environment. By involving compliance, engineering, and end users early, the project moved from concept to validated prototype in just eight weeks — setting the stage for a pilot that could transform how tax professionals interact with IRS systems.