Project Overview

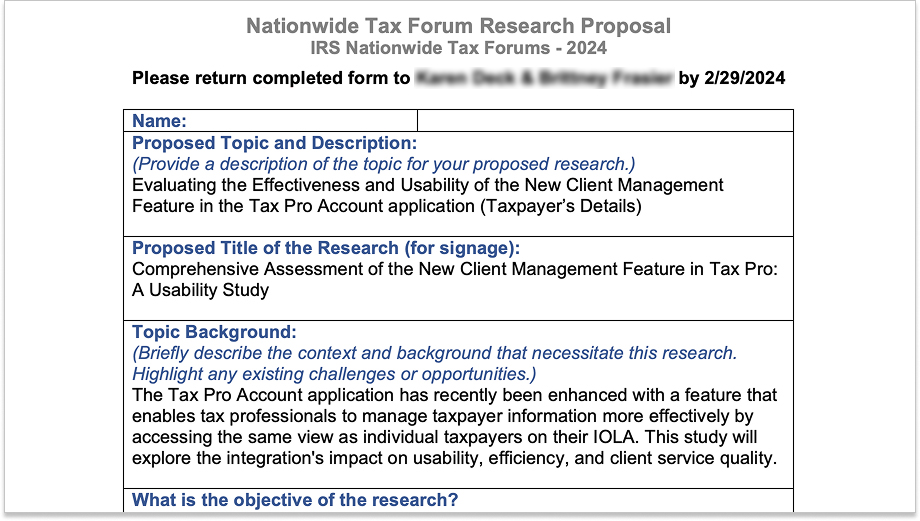

As the Design Lead for the IRS Tax Pro Account, I spearheaded a usability research initiative at the 2024 Nationwide Tax Forum (NTF) to evaluate how effectively the Tax Pro Account supports tax professionals in managing individual and business clients. This initiative involved end-to-end planning—from proposing the research, developing a clickable prototype, and preparing a detailed moderator guide, to executing over 40 user testing sessions across five cities.

Problem

Tax professionals were struggling with fragmented IRS tools and unclear pathways for completing client-related tasks such as managing authorizations, viewing balances, and accessing transcripts. The IRS needed real-world insights to refine the Tax Pro Account and increase its adoption.

My Contributions

- Proposed the Research: Authored and submitted the formal NTF research proposal to evaluate the new Client Management feature

- Moderator Guide: Created a comprehensive script and testing guide for moderators and notetakers

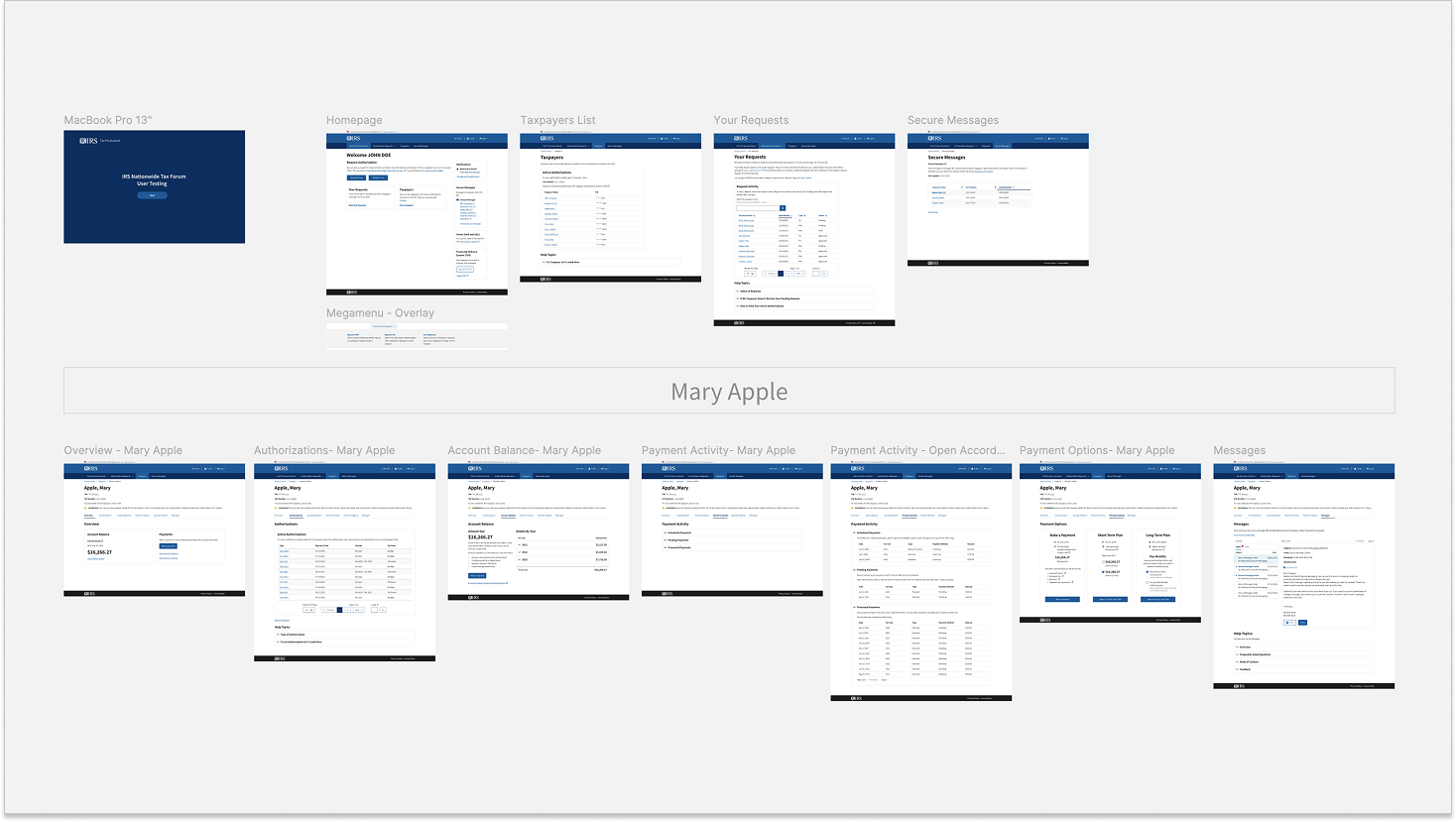

- Prototype Creation: Designed and prepared a clickable prototype tailored for in-person usability testing

- Field Team Support: Provided remote support to the field team during live sessions across five cities, ensuring smooth facilitation and troubleshooting if needed

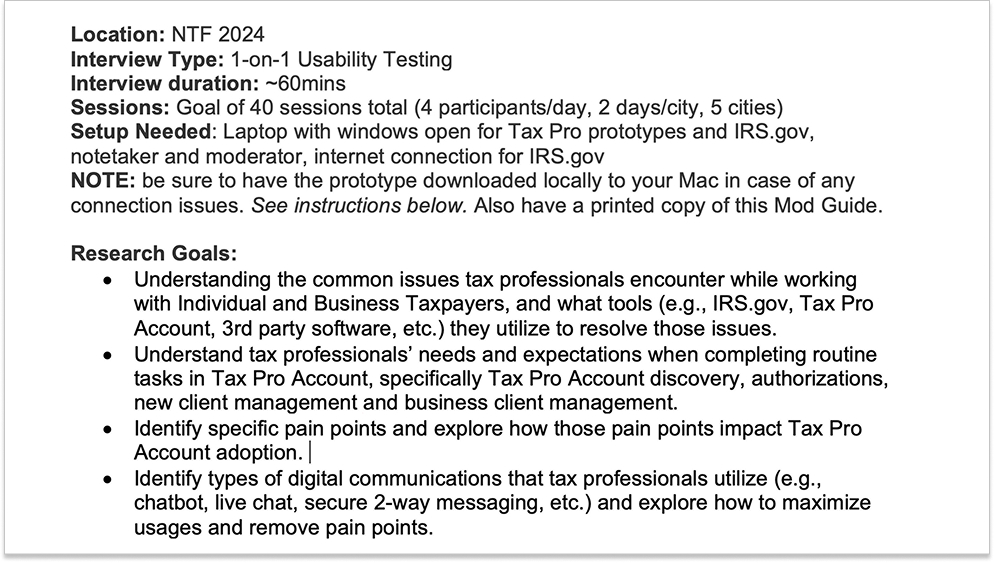

Methodology

- Research Type: In-person, moderated usability testing

- Participants: 40 tax professionals (mix of CPAs, EAs, and others with CAF numbers and Form 2848/8821 experience)

- Cities: Chicago, Orlando, Baltimore, Dallas, San Diego

- Tools Tested: IRS.gov navigation, Tax Pro Account prototype (client management, payments, messages)

Key Findings

- Login experience was inconsistent and often seen as burdensome

- Participants wanted clearer categorization, simplified payment sections, and better messaging features

- Search functionality on IRS.gov and within Tax Pro Account was a repeated pain point

- Features like real-time status tracking, easier access to transcripts, and direct communication channels with the IRS were highly requested

Outcome & Impact

- Compiled findings into a feedback report shared with product and engineering

- Helped prioritize backlog items such as:

- 🔍 Search for specific taxpayers (now in development)

- 📢 Better status tracking and notifications (planning)

- 🧾 Direct access to transcripts and notices (planning)

- 💬 Communication features (now in development)

- Elevated visibility of tax pros’ unmet needs, helping shape the roadmap for FY25

Lessons Learned

- Pain points outside the application (like ID.me) can deeply affect product perception

- Just because a feature exists doesn’t mean it’s discoverable or useful in its current form

- Forum-based in-person testing gave us rich, authentic insights—many of which would be missed remotely

Note: Due to the sensitive nature of this federal government project, detailed prototypes, internal documentation, and research artifacts cannot be shared publicly.