Overview

Since June 2022, I’ve served as the UX/UI Lead Designer for the IRS Tax Pro Account, a comprehensive digital platform supporting Tax Professionals in managing client information and authorizations efficiently. Tasked with guiding the application’s design direction, I ensured consistent and intuitive experiences that met stringent federal standards and addressed complex user needs. Collaborating closely with research lead, product owner, product manager, business team, scrum masters, developers, and stakeholders, I advocated a user-centric approach that informed every design decision.

Challenges & Strategic Initiatives

Process Optimization from Sketch to Figma

Recognizing the need for structured workflows early in the project, I initially created a comprehensive Master File in Sketch. As our design processes evolved, I led the seamless transition to Figma, developing a new robust organizational structure within Figma that significantly improved collaboration, streamlined developer handoffs, and facilitated seamless onboarding of new designers. My established Figma structure was highly effective and has since been adopted by other products within the IRS, underscoring its impact and scalability.

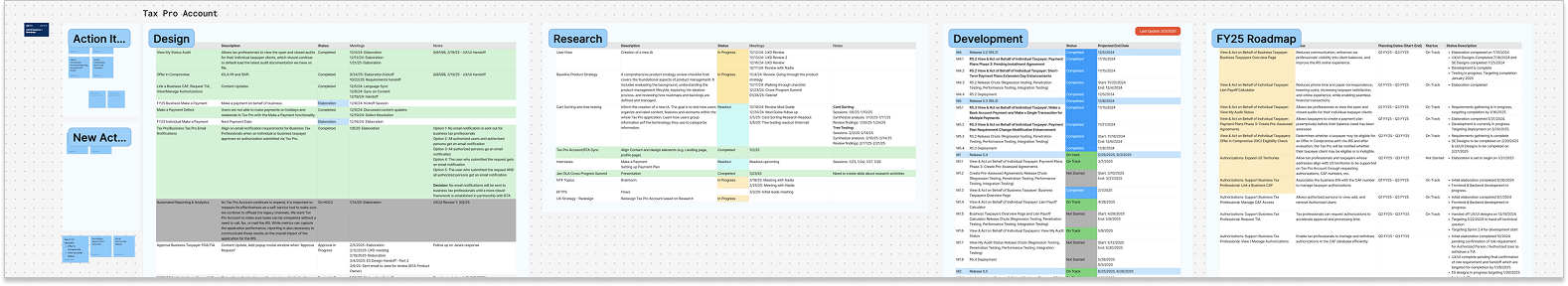

Accelerated Roadmap and Lean UX Implementation

Facing an ambitious roadmap with over 50 feature releases, I introduced a Lean UX framework to accelerate design iteration and feedback loops. By incorporating rapid prototyping, iterative testing, and immediate stakeholder collaboration, our team successfully delivered complex features at an unprecedented pace, meeting deadlines without sacrificing usability or quality.

Cross-Product Collaboration

Though primarily responsible for the Tax Pro Account, I proactively collaborated with the design leads of complementary IRS applications—Individual Online Account (IOLA) and Business Taxpayer Account (BTA)—to align our design patterns and ensure consistency across user experiences. By embedding consistent user information patterns across these applications, we improved overall trust and usability for Tax Professionals and their clients.

Methodologies & User-Centric Approach

Comprehensive Agile Collaboration

Establishing effective collaboration with scrum masters, developers, and stakeholders, I fostered a unified, agile culture. Regular sprint planning, daily stand-ups, and continuous feedback sessions streamlined workflows, ensuring timely and effective communication that directly influenced product success.

Rigorous User Research & Testing

In close partnership with the Tax Pro Research Lead, I spearheaded extensive user research initiatives, including:

- Card Sorting and Tree Testing: Informed information architecture by understanding how users categorize and label content.

- Prototype Walkthroughs & Interviews: Gathered qualitative insights into user behaviors, expectations, and pain points.

- Surveys and Analytics Data: Leveraged quantitative data to validate design decisions and prioritize features based on user needs and behaviors.

This comprehensive research strategy allowed us to design confidently, grounded in validated user insights.

Outcomes & Impact

Seamless and Reliable Design Delivery

Despite significant resource constraints, our agile methodologies and robust organizational systems allowed us to sustain continuous design deliveries without interruption. Our proactive strategy mitigated potential risks and ensured ongoing development remained aligned with our user-centric vision.

Enhanced Consistency & Usability

Our meticulous focus on cohesive design patterns significantly improved the usability and navigability of the Tax Pro Account. Feedback from user testing consistently highlighted the application’s ease of use, clarity, and intuitive design.

Scalable Architecture for Future Growth

The insights gathered through comprehensive user testing informed our strategic redesign of the application’s future state. By refining the information architecture and user flows, we ensured the platform could effectively accommodate ongoing and future feature expansions without compromising the user experience.

Conclusion & Reflection

My role as UX/UI Lead Designer for the IRS Tax Pro Account highlights my ability to blend strategic foresight, resilient problem-solving, and dedicated user advocacy. Through agile innovation, extensive user research, and effective collaboration, I successfully led a complex design initiative—ultimately enhancing user experiences and laying a strong, scalable foundation for future growth.

Note: Due to the sensitive nature of this federal government project, detailed prototypes, internal documentation, and research artifacts cannot be shared publicly.